Welcome to

STELLAR ASSETS

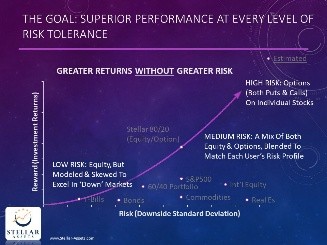

Designed to Outperform in Any Market… Actively Managed Equity & Option Strategies

Our Products

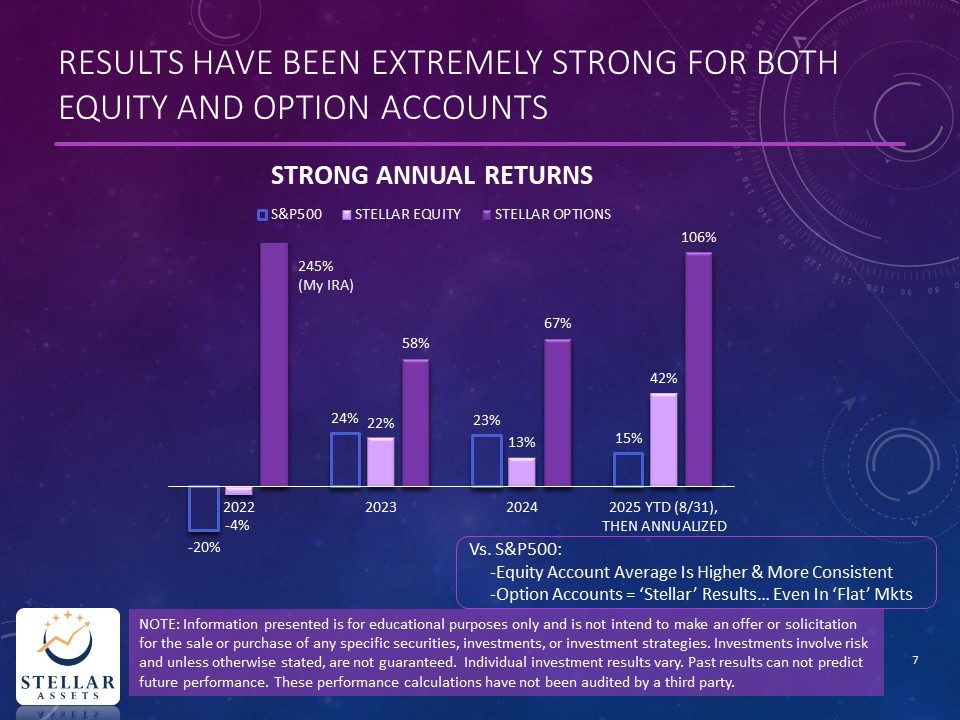

Performance results have been excellent for both equity accounts and accounts with option overlays, and can be accessed HERE. Hedge funds are expected to have similar performance.

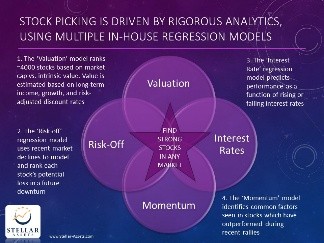

Regression Modeling

Combining Value, Momentum, & Risk Management

We constantly analyze over 3000 stocks to find those that can thrive in a variety of market conditions. We then rank each stock based on a variety of market conditions, including:

1. Value: Market capitalization of each company is compared to predicted value based on sales, growth, smoothed profit margins, and a discount rate appropriate based on company characteristics

2. Risk-off: We use regression analytics and the most recent major market declines to model potential losses, by stock, during any future potential sell-off.

3. Momentum: Similar to Risk-off modeling, we use recent market gains to identify factors most closely associated with individual stock outperformance… should positive market momentum continue.

OUR Philosophy

Prudent Risk Taking

At Stellar Assets, we believe in prudent risk-taking on undervalued companies. We always try to buy low and sell high, which in practice often means taking positions in companies which Wall Street has shunned. These appear to be fundamentally sound companies, but recent negative price action has forced the Wall Street fashion show in another direction. We can be patient. We often acquire more when others abandon ship as perception and related job preservation force the last remaining analysts to reluctantly issue their sell orders. Please see Our Approach for more details or contact an investment professional.

Realizing your financial goals need not be complicated. We believe we can help via the 4-step process below!

Want to learn how this strategy could work for your portfolio?

Here’s what our clients think

John tripled my account in just two & a half years, so I’m more than pleased! Letting Stellar manage my money was one of the best financial decisions I’ve ever made. They've had me invested mostly in options, so I’ve had to deal with higher volatility (and higher taxes ), but more than a fair tradeoff. This has been a great call for my ‘play’ money. I convinced one of my sons to invest this year and he’s also up nicelJohn tripled my account in just two & a half years, so I’m more than pleased! Letting Stellar manage my money was one of the best financial decisions I’ve ever made. They've had me invested mostly in options, so I’ve had to deal with higher volatility (and higher taxes ), but more than a fair tradeoff. This has been a great call for my ‘play’ money. I convinced one of my sons to invest this year and he’s also up nicely. “This is the place” if you want your money to work even harder than you do!y. “This is the place” if you want your money to work even harder than you do!

Cal, Retired Pilot

The “options only” bucket that I’m in is one I signed up for. I knew volatility was integral to this trading model. So I’m accepting the risks to gain the rewards. It’s quite a bit more of volatile than I imagined. Although overall, I’m very happy with the results to date. I would say this trading model requires a lot of patience, but Has the potential to produce outsized returns. I’ve gotten great returns through this model but definitely had to wait through a full 10 to 12 month cycle. it’s not for the faint of heart, but I think John has nailed the capability of producing great returns over the medium term

Dan, Retired VP

What I love about working with John is his openness to tailoring a strategy to our needs. When we started with John, we enacted a very conservative approach. The results we saw were decent, but we soon realized that we were going to need more to meet our retirement needs. We met with John about this and he suggested a strategy of adding in an options component for part of our portfolio. Since that change, our returns have been phenomenal! We are now well on our way to meeting our retirement goals. We love working with John and what he is doing for us!

Kevin, Sr. Executive

As a Sales Manager with a strong focus on performance and results, I’m selective about where I invest my resources. Stellar Assets impressed me with their professionalism, transparency, and strategic insight. Since partnering with them, my portfolio has delivered exceptional returns, exceeding all expectations. Their consistent performance and clear communication have earned my full confidence. I’m extremely satisfied with the outcomes and look forward to continuing a long-term relationship with Stellar Assets.

Richard, Sr. Executive

John Wright has done an outstanding job managing my investments. He has rigorous, disciplined, and repeatable process to identify undervalued stocks and profit from them. Of the 27 stocks in my account, 20 are currently green. There are 4 up over 20% and 5 up over 30%! There are very few advisors that can achieve these levels of success. I appreciate that John has also included option trading strategies. These really help me sleep better at night knowing that there is downside protection in place for any potential black swan events. I feel confident that John can not only minimize the damage from such an event, he can turn a profit. My investments have grown significantly under John’s management and I highly recommend him to anyone looking for help to grow their portfolio.

Doug, Retired Engineer

Working with John has given me a tremendous sense of financial confidence and clarity. I always know my investments are being thoughtfully managed with my long-term goals in mind. His consistent communication, trustworthiness, and guidance have made a real difference in how I plan for the future. I highly recommend him to anyone looking for a reliable financial partner.

Hayden, Sales Executive